how do you calculate cash flow to creditors

This results in the following cash flow from assets calculation. Cash flow to creditors Interest - Net new LTD Net new LTD LTDend - LTDbeg Cash flow to creditors 1325 - 35229 - 29060 -4844 Net new equity Common stockend - Common stockbeg Common stock Retained earnings Total owners equity Net new equity OE - REend - OE - REbeg OEend - OEbeg REbeg - REend.

This is a negative cash flow.

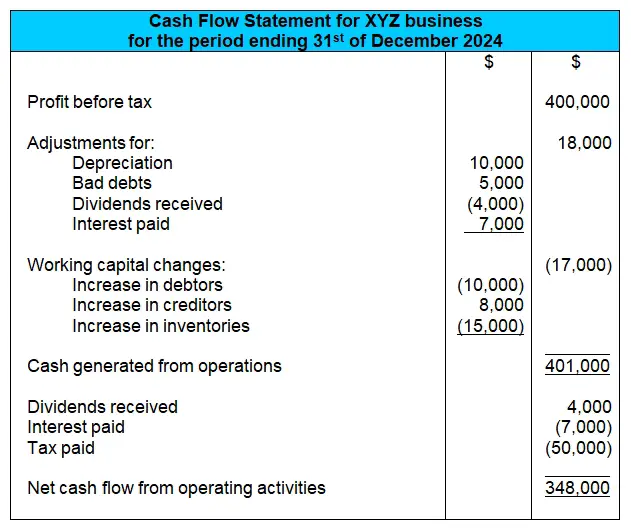

. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Cash Flow Forecast Beginning Cash Projected Inflows. The statement of cash flows acts as a bridge between the.

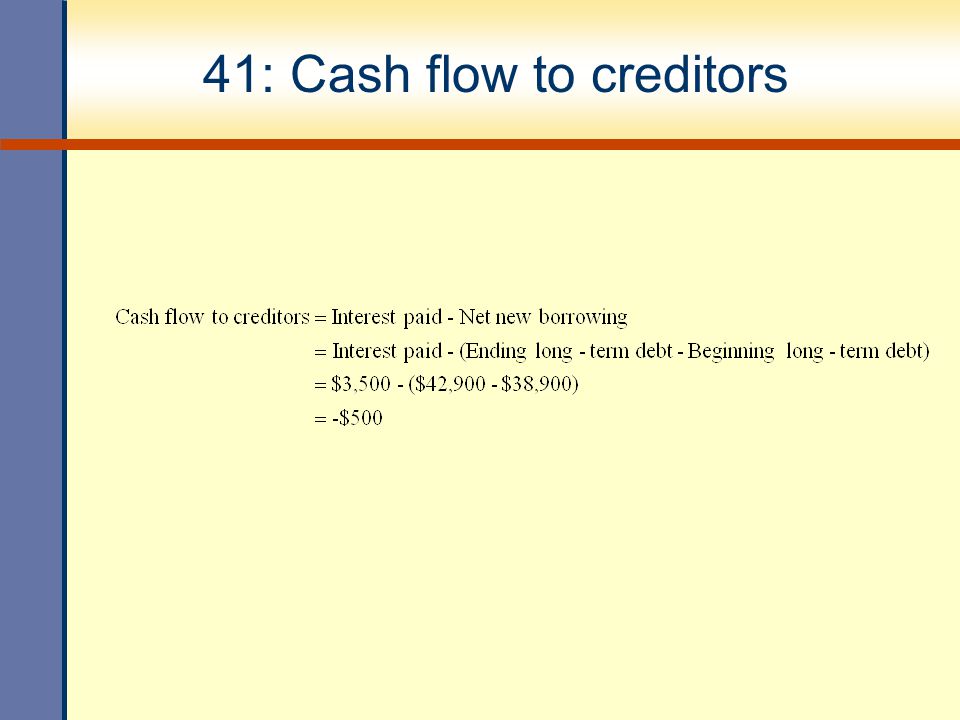

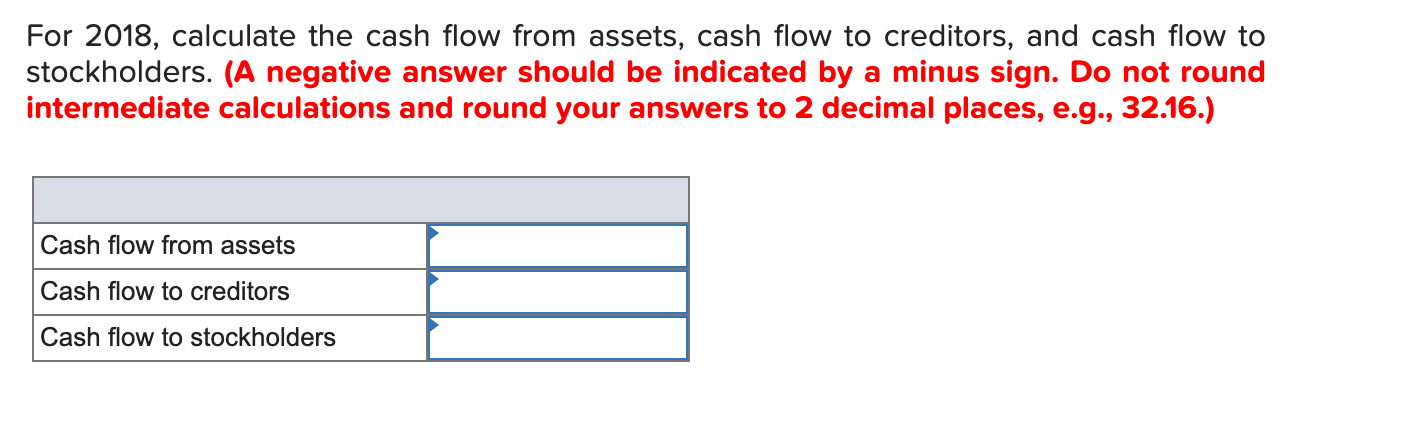

The money moving between a company and its owners investors and creditors are called the financing cash flow. Cash flow to creditors Interest paid New long-term debt Cash flow to creditors Interest paid Long-term debt end Long-term debt beg Cash flow to creditors 24120 190000 171000 Cash flow to creditors 5120 The cash flow to stockholders is a little trickier in this problem. Determine the amount of long term debt at.

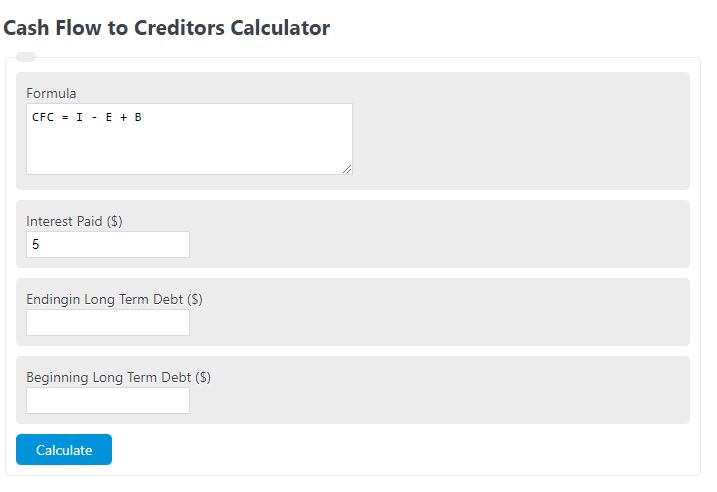

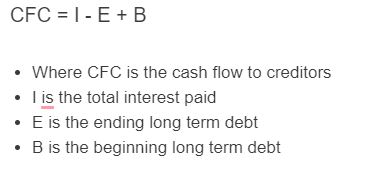

Cash Flow to Creditors cf C Formula and Calculations cf C i - d E d B cf C - cf C Calculator Input Values Amount of Interest Paid i Ending Long Term Debt d E Beginning Long Term Debt d B 87 Votes How is Cash Flow to Creditors Calculated. Cash flows for Managerial Accounting Statement of Cash Flows. Rated the 1 Accounting Solution.

To calculate FCF locate the item cash flow from operations also referred to as operating cash or net cash from operating activities from the cash flow statement and subtract capital. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. Calculate the net cash flow from operating activities.

Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Working method of operating cash flow is. Cash Flow to Preferred Stockholders.

Put them each on individual lines. Operating Cash Flow is calculated using the formula given below Operating Cash Flow Operating Income Depreciation Amortization Decrease in Working Capital Income Tax Paid Deferred Tax Paid Operating Cash Flow 20437 million 10529 million 3243 million 6179 million 304 million Operating Cash Flow 28334 million. To calculate investing cash flow add the money received from the sale of assets and any amounts collected on loans and subtract the money spent to buy assets and any loans made.

The cash flow to creditors is. Calculate the total interest paid. Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt.

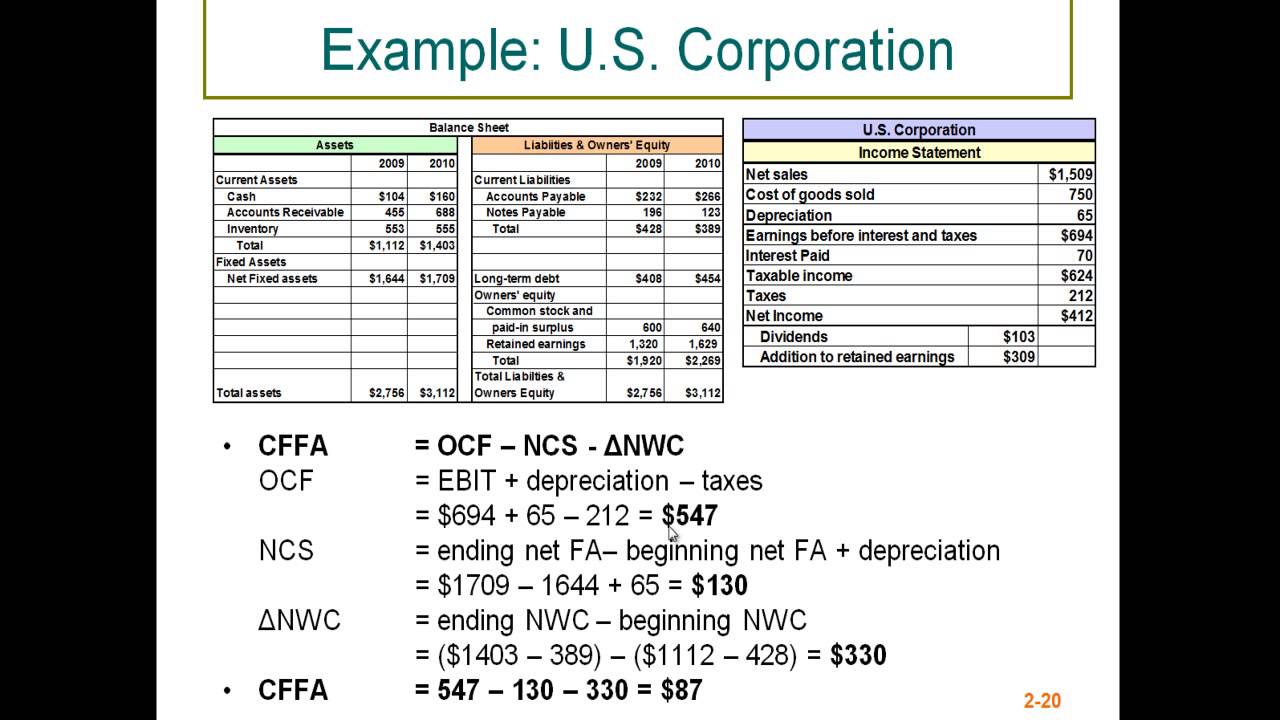

First you will take EBIT 103562 and add back the depreciation amount 69038 because it is a non-cash transaction. Calculating Cash Flows Calculating Owners Equity Net Working Capital Fixed Assets Long Term Debt and Cash Flow to Creditors Direct and indirect methods of cash flow from operations Cash flow to creditors Cash flow to stockholders Financial ratios for Just Dew It Braam Fire. 18500 -15000 -30000 -26500 Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to December.

Basic Formula The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes. Next calculate the outflow. Complete the Cash Flow Equation Calculate the cash flow to stockholders of common shares which is equal to the dividend payments minus new stock issues plus repurchased shares.

Ad QuickBooks Financial Software. Add the two together to get a total cash balance of 13000. Determine the amount of long term debt at the end of the period.

Cash Flow From Creditors Example First determine the interest paid. How to Calculate Cash Flow. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

To conclude the cash flow equation example the cash flow is 11 million 20 million - 10 million 1 million. The formula looks like this. Your most regular cash expenses will probably be rent a.

Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. There arent any complex financial terms involvedits just a simple calculation of the cash you expect to bring in and spend over typically the next 30 or 90 days. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow forecast Beginning cash Projected inflows Projected outflows Operating cash flow Net income Non-cash expenses Increases.

Operating Cash Flow Formula. Next determine the ending long term debt. Thus we get 103562 69038 27703 144897.

Nd your credit card andor loan payments. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used. Downgrade to CCC followed by bankruptcy 20 x 20 and upgrade to AAA followed by bankruptcy 15 x1.

Include income from collection of receivables from customers and cash interest and dividends received. Add up the inflow or money that came in from daily operations and delivery of goods and services. Heres how to calculate the cash flow from assets.

This shows they spent more than they earned in. An alternative means of calculating the average collection period is to multiply the total number of days in the period by the average balance in accounts receivable and then divide by. Another cash flow that we need to take account of is the tax payment 27703 which we are going to subtract from the EBIT value.

Next determine the beginning long term debt. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities. The anticipated cash flows that are payable are equal to the premium in the first year 4 and 95 of the premium in the second year 95 x 438.

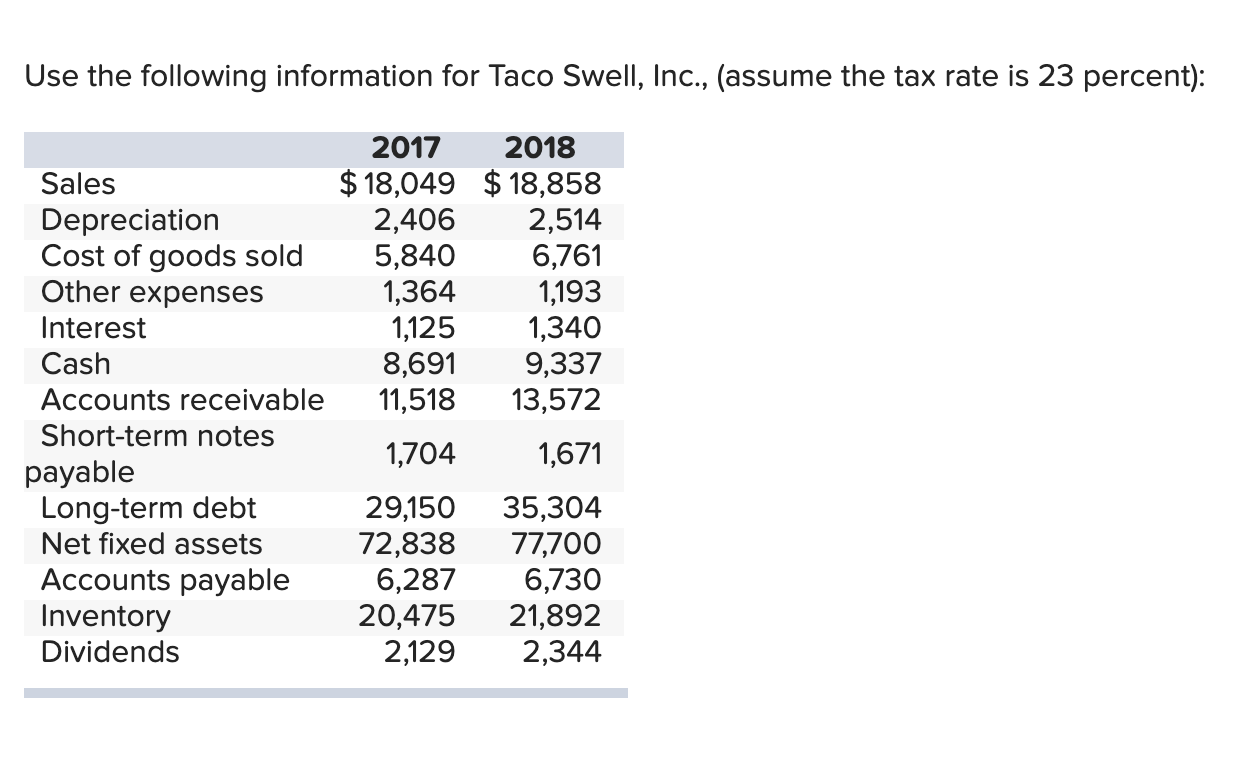

Solved Use The Following Information For Taco Swell Inc Chegg Com

Cash Flow To Creditors Calculator Finance Calculator Icalculator

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Operating Cash Flow Formula Calculation With Examples

Cash Flow Statement Overview A Simple Model

The Indirect Cash Flow Statement Method

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Cash Flow To Creditors Calculator Calculator Academy

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Cash Flow To Creditors Calculator Calculator Academy

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)